Sunday 30 November 2008

Midterm Project- Pre-Campaign

Mid-Term project - Google AdWords

Client Overview:

Client Profile:

http://snowfactory.pixnet.net/blog; http://liyihui.myweb.hinet.net/newstore2.html; Yahoo.tw bid ID: snowfactory100

Snow Factory is a homemade yogurt producer located in downtown Taipei, Taiwan. It was founded in July 2007 by Li Yi-Hui and Su Li-Wen with joint investment of 300,000NT$. Three employees, including the founders, make hand-made yogurt and chewable fruit jam in a working environment much like one’s home. The inspiration of the business came from Li Yi-Hui’s participation in a yoga class taught by an Indian instructor. According to Su: “I couldn’t find a home made, chemical free, not sour yogurt in my local market, so I decided to make one for myself”. Snow factory offers both on/offline purchases. Online marketing and promotion are done through bid.yahoo.tw, personal blog of Li Yi-Hui’s, and a webpage on hinet.net. At the moment, Snow Factory is not using Google AdWords. Their on/offline combined monthly sales revenue averages around 400,000NT$.

Marketing Analysis:

Product, Price

Snow Factory defines its core product as “scoopable”, least sour, artificial chemical free yogurt. The company ensures quality in their products by not using milk powder and artificial additives. Taiwan’s most famous milk brand-Lin Feng Ying’s full-fat, pure cow milk is chosen as the main ingredient. The product is packaged in 168+-5% gram cups and placed in a dozen cup boxes. Each 168g cup of Snow Factory yogurt is priced at 36NT$. To add more flavors to the original taste of sugar-free yogurt, Snow Factory made chewable jams (with fruit flesh) of several flavors (Da Hu strawberry, apple, Tao Yuan mulberry, mango, papaya, litchi-honey, apple + passion fruit, pineapple) are offered. A cup of yogurt with a scoop of home-made jam is 45NT$.

Place, Promotion

Considering the size and scope of the organization, Snow Factory doesn’t offer shop display sales, and takes advantage of “free” marketing channels to promote its product. W.O.M is spread around through social-networking tools like famous local blogs. Yahoo bidding is chosen over other channels due to its reach on the local market. The main webpage is placed on webspace provided by hinet.net. Transaction is made through ATM transfer and land parcel delivery. Customers can receive the yogurt in person at Taipei Gu-Ting MRT station with prior contact.

Competition

We define Snow Factory’s industry as “fresh” food - dessert industry. Under this broad classification, all dessert and yogurt producers, Uni-President being the largest, would be its competitors, but Snow Factory is serving a niche market of home-made yogurt. At the moment, the competitors of the niche are Granny Sara, Osiana, Asenka, and Yoplait. They all make spoonable, home-made yogurt of different taste and package offered in-store. Considering the number of competitors, and their respective market share, this home-made yogurt niche has large segment to be conquered by the incumbents and new entrants, hence the market is competitive, and it is in its early majority position of the S-Curve.

Customers

According to the managers, the original target customers were 20-30 year old, health conscious office females, but along the journey, they observed that mid-age house wives were the largest buyers, and young teenagers through their mothers’ recommendations. We believe that the potential customers will still remain to be adult females, and teenagers, because men who don’t like sour are very common in Taiwan. Among the potential customers, environmentalists (one can get 10NT$ refund on reuse of a Snow Factory yogurt box), vegetarians, alternative therapy supporters (yogurt helps digestion), naturalists (the yogurt can be used as a natural skin whitener) might make up majority of the target segment.

Current Marketing:

Snow Factory’s main online content, all in Traditional Chinese, is placed on Li Yi Hui’s personal blog, a single web-page on hinet’s myweb, and on yahoo bidding platform. The whole information about the business inspiration, the product, complementary fruit jams, links to customers’ comments on different blogs, news reports about the business, product pricing, ordering method, preservation and use of the product are knitted on a single page.

One should download an order form (.xl file), fill it, and send it back to the company’s e-mail address along with money transfer over ATMs. Besides internet communication, telephone orders, fax orders are also acceptable. It's been noted that most of the repeat buyers were 30 years of age, economically stable, married females, who relied less on internet to buy yogurt. Hence, unless Snow Factory offer special and unique content that not only adds to the original value proposed, but also requires only internet to be access, offline promotion and sales seem to be generating most of the profit.

An online marketing for such a young company should focus both on increasing brand awareness and ROI. Snow Factory’s same information is scattered around several platforms (BBS, blogs, its webpage on hinet). From a strategic point of view, information with same images, similar slogans, long web-pages with ordering information on the lower part might serve as solid brand awareness builder, but it may come at higher risk of pushing away customers due to dullness, or “overcrowdedness” of information. We believe that Snow Factory’s web-page contains too much information on a single page (too many words). One should look over everything before reaching the ordering section. Also, payments are made over ATM transfers; hence it is difficult to measure sales dollars made “online”. On the other hand, the page contains several sections that tell the quality certification, comparison of the product to incumbents on several factors, refrigeration, different uses of yogurt, and clear photos of the product with whitish tone that have artistic, sanitary feel to it. Should Snow Factory change their webpage, we have already thought of several key measures to be addressed on the new site.

Incumbents of the niche mentioned above use local celebrities to endorse their products to the mass, but Snow Factory hasn’t engaged in any “real” advertisement campaigns yet. Their brand awareness has been established through PR. The page has several links to news reports about Snow Factory. Bloggers serve as the most effective, free advertisers for their product.

Because Snow Factory is mentioned on so many blogs, only the two Chinese characters for Snow Factory typed on Google search engine brings about 210,000 web results.

Conclusion

Our goal in this project is to increase sales dollars through more sales leads sent from Google AdWords. The timing of the project has aligned with a recent incidence of poisonous (tainted, melamine) milk powder sent all over Asia from mainland China, which pushed lots of customers away from dairy products in Taiwan. We will turn this threat into an opportunity by emphasizing the use of Taiwan produced pure cow milk, and all hand-made complementary jams. Also, as December approaches, we will utilize the name of the brand – “Snow” Factory in ads related with seasonal themes such as winter, snow, Christmas… In Taiwan, the top three portal sites are Yahoo.tw, Wretch.com, and Google.tw. Studies show that when Taiwanese people search for information on Google, they refer to the search results with informatory, academic, news report seeking mindsets that automatically block advertisements shown around the organic result. Ad agencies believe that banner ads work better than keyword text ads. Therefore, in order to attract more potential customers to the site, we will not only use keywords, but content network tied with most visited Taiwan sites (YouTube, Wretch…). Since customers refer to Google as a serious (academic) search engine, so we’ll focus on the “news worthiness” of our text messages.

Proposed AdWords Strategy

The ad copies will be written in Chinese, but will be connected with few English keywords to increase impressions. Because Snow Factory doesn’t own a store display, hence Geo-targeting ads coupled with Google Maps will not work.

Considering the current trend of the business, the target audience is still all females, and those health conscious males who don’t mind a little sourness in yogurt. The coverage area is all Taiwan.

So far we have come up with 3 ad groups. The corresponding themes are: Winter/Christmas, Beauty/Health, New business/Entrepreneurship. The three text ads with their corresponding keywords are as follows:

1. 雪坊優格 冬季最美的甜點

100%林鳳營鮮乳製造雪白優格,搭配繽

紛的天然果醬,最時尚的聖誕禮物。

(Keywords: 布丁, 甜食, 下午茶, 聖誕節, 冬天, 冬季, 雪, 爬山, 鮮奶, 鮮乳, 甜點, 果醬, 天然, 時尚, 禮物, 優格, 優酪乳, 奶酪, 乳製品, 林鳳營, 果粒, 果肉,Christmas, x-mas, winter, )

2. 雪坊優格 時尚美容聖品

純手工優格,100%天然食材,僅市售1/2

的卡路里,享瘦同時,美麗加分。

(Keywords: 手工, 天然, 食材, 卡路里, 熱量, 瘦身, 瑜珈, 美容, 美白, 曬黑, 肌膚, 減肥, 發酵, 代餐, 消化, 零食, 美女, 鮮奶, 鮮乳, 莎拉奶奶, 植物的優, 林志玲, 楊丞琳, 優沛蕾, 大滿足, 才不會忘記你呢, Christmas, x-mas, winter, )

3. 雪坊優格 研究生創業夢想

三位台大商研所學生,製作香滑細緻的優

格,一同來感受細心與耐心的創業故事。

(Keywords: 商研所, 台大, 台灣大學, EMBA, 大學生了沒, 大學生, 研究生, 蘇立文, 黎懿慧, 周慶麟, 創業, 創新, 微型企業, 創意, 中小企業, 白手起家, 政大法律系, 故事, 感人, Made in Taiwan, Taiwan)

Negative Matches: 鬼, 吃到飽, 樹, 公公, 聖誕帽, 舞會, A片, 肥皂, 資源, 石材,

Although Wretch, the second most visited site in Taiwan, is not listed among Google content network list, but based on our budget performance, we’ll use content network from time to time.

Our three week 2000NTD budget will be distributed as 650NTD, 350NTD, and 1000NTD respectively. After checking each keyword on keywords ideas by Google, we have found out that the keywords we have selected cost around 2NTD per click (dieting, and loosing-weight are around 15NTD). Daily budget will be allocated as 2/3 of the weekly budget over Monday to Friday, and remaining 1/3 over Saturday and Sunday.

Our goal is to increase Snow Factory’s sales and brand awareness by burning all of the 2000NTD over the whole project period. Considering average CPC as 2,5NTD, our projected clicks are 800 clicks. Projected impression is around one million eyeballs.

Keyword advertising is a trial-and-error business. Therefore, we’ll adjust our bidding, and budget maximum daily to filter out the most suitable keywords for the most suitable time.

Because, Snow Factory’s online contents do not offer direct sales online (online credit card payment e.g. PayPal), it is difficult to measure more conversion rate accurately. We’ll take each download (click on .xl file) of the order form of Snow Factory as real buyer, and each clicker on our ad as potential customer.

Google campaign

Tuesday 25 November 2008

MySpace Case Review

Since Facebook has a good at filtering the users ‘the quality of the web site also built up successfully which attracted many "on campus" (the most creative and active demographics on the internet in terms of content creativity and speed)students who had access to the internet. Parents of those cyber bully victims favored to facebook as it is the role model accumulation of schools they would like to send their kids to. Facebook guaranteed their user identity by adding features like identifying a person on photos spread over different profile photo folders.

Unlike MySpace, facebook uses easily recognizable, "eye friendly", standard profile layout without customization option of the profile cosmetics. This is also related to quality of the web site as well as the web site users. MySpace attracted youngsters through the ability of high customization of the profile interface. Since facebook was in business of more "mature" social gathering, google like interface attracted majority of the internet surfers. However although Facebook sound like to be ordinary, the team of management come over this problem through attractive applications written by those who are interested in software development, but lack large audience with standard platform for the application to be tested. On the other hand, MySpace needs to find a way to compete with Facebooks Platform that has introduced thousands of different applications. Since launching its application platform, Facebook attention has grown over 50%.

To sum up; Facebook deserve where it’s today for several reasons mentioned above and furthermore : easy entry, exit, all you can eat application revenue generation through ads, sponsorships, or even selling merchandise, quick response rate, feedbacks enabled by up to date metrics by facebook attracted more and more developers. As a result of all these basis on April 19, 2008, Facebook overtook MySpace as a social networking site leader. And Facebook now ranks number five, being ahead of MySpace, which ranks number six. Overall, Facebook not only pose threats to MySpace but successfully overpass.

Question 2. Should MySpace join operations or invest in its own developer platform?

Monday 24 November 2008

MySpace

For questions 1,2: I think Facebook has been posing threat on MySpace from the first day it entered the competition battleground of social networking. Although MySpace was the spearhead in this area, or the first mover by establishing its brand awareness among users, but it failed to preserve its fame on several aspects:

The user ID trustworthiness. Although MySpace users have reached to almost 100 million users worldwide, but only 45% of the IDs are reported active within a month. One user, on average, owns 3 IDs on MySpace. The filtering process of adults from teenagers is weak, which has lead to several incidences of sex-maniacs' attack on youngsters. Facebook on the other hand has built its reputation by clever choice of audience - first Ivy League colleges in the U.S, then regular colleges, which attracted many "on campus" (the most creative and active demographics on the internet in terms of content creativity and speed)students who had access to the internet. Parents of those cyberbully victims favored to facebook as it is the role model accumulation of schools they would like to send their kids to. Facebook guaranteed their user identity by adding features like identifying a person on photos spread over different profile photo folders.

Content layout: unlike MySpace, facebook uses easily recognizable, "eye friendly", standard profile layout without customization option of the profile cosmetics. MySpace attracted yougsters throught the ability of high cusomization of the profile interface. Since facebook was in business of more "mature" social gathering, google like interface attracted majority of the internet surfers.

API-proprietory add-ons: Facebook attracted users through attractive applications written by those who are interested in software development, but lack large audience with standard platform for the application to be tested. Easy entry, exit, all you can eat application revenue generation through ads, sponsorships, or even selling merchandise, quick response rate, feedbacks enabled by up to date metrics by facebook attracted more and more developers. Users on the other hand, spread those application virally thanks to News feed feature on facebook profiles. MySpace users had to enter one's profile to see what's been added. Utilizing first mover's advantage, facebook has built up its empire of free applications, and strong-bond social groups before MySpace.

Although MySpace could come up with, or even join Google on open-source applications the train has left already. It is mentioned in the case that developing its own proprietary software platform would enable MySpace to differentiate itself from competing websites like Hi5, Friendster... as they use OpenSocial, homogeneity will prevail. But developing a software platfomr is too costly. Even if it did develop its own software platfrom, the value proposition for developers should be sweeter to facebook's. Facebook on the other hand has much larger collection of the real "face-applications",and tie with "face-sites" like flickr... The inertia of Facebook can be raised passed only by those who offer completely different value creation, and proposition on social networking. MySpace, the largest victim of its laggardness to new possiblities, should redefine its position, get out of the red and sink into blue ocean by establishing demand, not looking for one, and perhaps rename itself before challenging facebook on the new arena of social-networking.

Deniz's Input for Myspace

Exactly. Facebook is increasing its audiences dramatically. Actually the threat from facebook is not just related to numbers. Moreover the quality of the web site is also another threat for Myspace. Since the early stages of Myspace, the security / privacy concerns of the audiences were not guaranteed by Myspace. However for the Facebook , the core of all web site was built up on the privacy of the costumers. For the security and privacy issues, facebook is offering the site users some options to choose out of some security concerns to keep their personal info(even e mail and cell phone ) or page out of the people who they do not know(or who are not in his/her network). For Myspace, for a certain level, the site is encouraging people to enlarge their networks which is decreasing the safety of the people.

Incidentally, another ‘quality’ issue is related to the ‘education level’ of the web site users. For Facebook which took its roots in Harvard University, the membership requirement is based on the large university/college/faulty web and even sometimes to join a network, the auditors have been asked for their faculty e mail addresses. As mentioned in the case, this application has certainly increased the quality of the auditors. On the other hand, Myspace aimed to increase the network of the people, by enriching it upto the teenagers and even to the kids.

Besides all there are some other reasons that Facebook is challenging Myspace. This can be clearly understood by the outbreak of Facebook in whole the world in recent years. So Facebook is and will be a threat for Myspace definitely.

2. Should MySpace join OpenSocial or invest in its own developer platform? It sounds me better for Myspace to develop its own developer platform. It seems that Myspac has already its back ground and name. Although it has a severe competitor like Facebook, Myspace has still better situation in terms of quantity which the recent surveys showed. (however it is certain that facebook will catch up soon if Myspace does not take any action) Myspace , may develop its service quality by this way and can differentiate itself still. By doing so thay can also plese their current users too, hence they have a considerable numbers of members in hand, already. Moreover Google s opensocial is on developpng process and nobody can guarantee the success of this participation..

Saturday 22 November 2008

Launch time

How do you guys think? :)

MySpace case (Shelley)

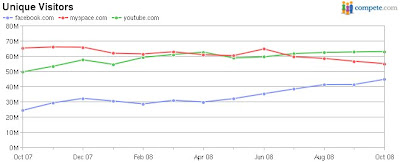

“Unique visitor” is a metric to measure no matter how many times people visit a site in a given month that only count once. From the latest profile we could see that the growth for both Facebook and MySpace are stable while unique visitors of YouTube almost double at a very short time. Today, MySpace still has twice of Facebook unique visitors in the U.S. and the interfaces between these two are similar. However, Facebook does pose a threat to MySpace due to following reasons:

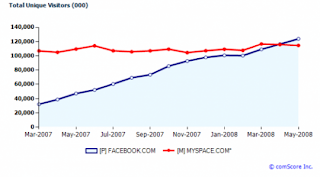

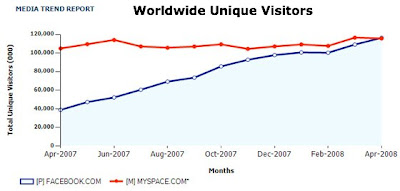

A) Facebook unique visitors overwhelm MySpace

Despite unique visitors grow stably in the U.S., the amount highly increase when measuring on a world basis. Actually, Facebook caught up MySpace in April 2008 in terms of unique monthly worldwide visitors. (Graph on right hand side is statistics from October, 2007 to October, 2008)

B) Facebook innovates more rapidly

MySpace founded a year earlier than Facebook but lack of innovation makes it change from a market leader to a market follower. Facebook dedicated to build multiple foreign languages to launch in more countries while MySpace tended to act in more traditional way.

C) Difference among functions and applications serving the customers:

a) Definition of “friends”: On Facebook the friends you add are usually your real friends in reality. On MySpace, people be friends even if they don’t know each other.

b) Privacy: Facebook set more limitations on providing a safer platform for people to keep their information in secret. MySpace has privacy but in relatively inferior.

c) “What’s new”: Facebook has two feeds rather than one. On Facebook you’ll know what’s new with you and what’s up with your friend but MySpace has former feed only.

April 19, 2008 was a historical moment that Facebook overtook MySpace as a social networking site leader. And Facebook now ranks number five, being ahead of MySpace, which ranks number six. Overall, Facebook not only pose threats to MySpace but successfully overpass. (See the pictures on the right.)

2. Should MySpace join operations or invest in its own developer platform?

Although join Google’s developer platform, OpenSocial, may bring more traffic and match Facebook functions quickly without investing in more resources. However, the disadvantages of using the platform are obvious – it may also accept competitors at the same time. However, comparing to loss of independence and lack of ability to fight back on its own, develops MySpace own platform will be a wiser choice. Although invest in own developer platform will make two sites look too alike as well as hard to differentiate their services, the steadily growth of unique visitors on Facebook shown that those applications are what customers really need. What’s more urgent for MySpace was keeping up with Facebook and expand its market by contracting with more websites for services. Additionally, MySpace can highlight its personalized interface and try to make its customers happier.

Friday 21 November 2008

MySpace Case (Andrea)

Definitely, I think Facebook is a strong competitor of My Space. For one Facebook provides more security and privacy for user’s personal information. An employee of Facebooks security team said, “if we get a report of a bug or a hole from a user, a security researcher, a reporter, blogger, or anyone, we check it out and fix it as quickly as possible.” Facebook allows members to restrict who they want to have access to their profile. MySpace has put itself in risking situations by not restricting access to profiles. Facebooks platform is also known to be a bit more professional and those who use it are usually higher class and educated. The communities that can be created create a place for people of the same entity which I think is a strength of Facebook. Another, strength of Facebook is its joining with Microsoft to help its advertising. A weakness of MySpace is that it is heavily skewed to a teen audience unlike facebook who is used by all ages. MySpace needs to find a way to compete with Facebooks Platform that has introduced thousands of different applications. Since launching its application platform, Facebook attention has grown over 50%. Overall I think Facebook poses multiple threats to My Space due to its many new applications, the trust people have in it and advertising.

2. Should MySpace join operations or invest in its own developer platform?

The downside of joining operations with OpenSocial is the “open source” which wouldn’t allow MySpace to limit applications to its social network. They want to differentiate themselves, joining with OpenSocial would defeat this purpose. If MySpace launches their own developer platform they can control all the operations to be launched in a timely way and to directly obtain profits. With their own platform MySpace could also apply their own unique strategies and continue updating and adding additional value to its users. As an update in February 2008 MySpace launched a developer platform utilizing OpenSocial and opened up its platform to third-party application developers.

Tuesday 18 November 2008

Mid-Term project - Google AdWords

Client Profile:

http://snowfactory.pixnet.net/blog; http://liyihui.myweb.hinet.net/newstore2.html; Yahoo.tw bid ID: snowfactory100

Snow Factory is a homemade yogurt producer located in downtown Taipei, Taiwan. It was founded in July 2007 by Li Yi-Hui and Su Li-Wen with joint investment of 300,000NT$. Three employees, including the founders, make hand-made yogurt and chewable fruit jam in a working environment much like one’s home. The inspiration of the business came from Li Yi-Hui’s participation in a yoga class taught by an Indian instructor. According to Su: “I couldn’t find a home made, chemical free, not sour yogurt in my local market, so I decided to make one for myself”. Snow factory offers both on/offline purchases. Online marketing and promotion are done through bid.yahoo.tw, personal blog of Li Yi-Hui’s, and a webpage on hinet.net. At the moment, Snow Factory is not using Google AdWords. Their on/offline combined monthly sales revenue averages around 400,000NT$.

Marketing Analysis:

Product, Price

Snow Factory defines its core product as “scoopable”, least sour, artificial chemical free yogurt. The company ensures quality in their products by not using milk powder and artificial additives. Taiwan’s most famous milk brand-Lin Feng Ying’s full-fat, pure cow milk is chosen as the main ingredient. The product is packaged in 168+-5% gram cups and placed in a dozen cup boxes. Each 168g cup of Snow Factory yogurt is priced at 36NT$. To add more flavors to the original taste of sugar-free yogurt, Snow Factory made chewable jams (with fruit flesh) of several flavors (Da Hu strawberry, apple, Tao Yuan mulberry, mango, papaya, litchi-honey, apple + passion fruit, pineapple) are offered. A cup of yogurt with a scoop of home-made jam is 45NT$.

Place, Promotion

Considering the size and scope of the organization, Snow Factory doesn’t offer shop display sales, and takes advantage of “free” marketing channels to promote its product. W.O.M is spread around through social-networking tools like famous local blogs. Yahoo bidding is chosen over other channels due to its reach on the local market. The main webpage is placed on webspace provided by hinet.net. Transaction is made through ATM transfer and land parcel delivery. Customers can receive the yogurt in person at Taipei Gu-Ting MRT station with prior contact.

Competition

We define Snow Factory’s industry as “fresh” food - dessert industry. Under this broad classification, all dessert and yogurt producers, Uni-President being the largest, would be its competitors, but Snow Factory is serving a niche market of home-made yogurt. At the moment, the competitors of the niche are Granny Sara, Osiana, Asenka, and Yoplait. They all make spoonable, home-made yogurt of different taste and package offered in-store. Considering the number of competitors, and their respective market share, this home-made yogurt niche has large segment to be conquered by the incumbents and new entrants, hence the market is competitive, and it is in its early majority position of the S-Curve.

Customers

According to the managers, the original target customers were 20-30 year old, health conscious office females, but along the journey, they observed that mid-age house wives were the largest buyers, and young teenagers through their mothers’ recommendations. We believe that the potential customers will still remain to be adult females, and teenagers, because men who don’t like sour are very common in Taiwan. Among the potential customers, environmentalists (one can get 10NT$ refund on reuse of a Snow Factory yogurt box), vegetarians, alternative therapy supporters (yogurt helps digestion), naturalists (the yogurt can be used as a natural skin whitener) might make up majority of the target segment.

Current Marketing:

Snow Factory’s main online content, all in Traditional Chinese, is placed on Li Yi Hui’s personal blog, a single web-page on hinet’s myweb, and on yahoo bidding platform. The whole information about the business inspiration, the product, complementary fruit jams, links to customers’ comments on different blogs, news reports about the business, product pricing, ordering method, preservation and use of the product are knitted on a single page.

One should download an order form (.xl file), fill it, and send it back to the company’s e-mail address along with money transfer over ATMs. Besides internet communication, telephone orders, fax orders are also acceptable. It's been noted that most of the repeat buyers were 30 years of age, economically stable, married females, who relied less on internet to buy yogurt. Hence, unless Snow Factory offer special and unique content that not only adds to the original value proposed, but also requires only internet to be access, offline promotion and sales seem to be generating most of the profit.

An online marketing for such a young company should focus both on increasing brand awareness and ROI. Snow Factory’s same information is scattered around several platforms (BBS, blogs, its webpage on hinet). From a strategic point of view, information with same images, similar slogans, long web-pages with ordering information on the lower part might serve as solid brand awareness builder, but it may come at higher risk of pushing away customers due to dullness, or “overcrowdedness” of information. We believe that Snow Factory’s web-page contains too much information on a single page (too many words). One should look over everything before reaching the ordering section. Also, payments are made over ATM transfers; hence it is difficult to measure sales dollars made “online”. On the other hand, the page contains several sections that tell the quality certification, comparison of the product to incumbents on several factors, refrigeration, different uses of yogurt, and clear photos of the product with whitish tone that have artistic, sanitary feel to it. Should Snow Factory change their webpage, we have already thought of several key measures to be addressed on the new site.

Incumbents of the niche mentioned above use local celebrities to endorse their products to the mass, but Snow Factory hasn’t engaged in any “real” advertisement campaigns yet. Their brand awareness has been established through PR. The page has several links to news reports about Snow Factory. Bloggers serve as the most effective, free advertisers for their product.

Because Snow Factory is mentioned on so many blogs, only the two Chinese characters for Snow Factory typed on Google search engine brings about 210,000 web results.

Conclusion

Our goal in this project is to increase sales dollars through more sales leads sent from Google AdWords. The timing of the project has aligned with a recent incidence of poisonous (tainted, melamine) milk powder sent all over Asia from mainland China, which pushed lots of customers away from dairy products in Taiwan. We will turn this threat into an opportunity by emphasizing the use of Taiwan produced pure cow milk, and all hand-made complementary jams. Also, as December approaches, we will utilize the name of the brand – “Snow” Factory in ads related with seasonal themes such as winter, snow, Christmas… In Taiwan, the top three portal sites are Yahoo.tw, Wretch.com, and Google.tw. Studies show that when Taiwanese people search for information on Google, they refer to the search results with informatory, academic, news report seeking mindsets that automatically block advertisements shown around the organic result. Ad agencies believe that banner ads work better than keyword text ads. Therefore, in order to attract more potential customers to the site, we will not only use keywords, but content network tied with most visited Taiwan sites (YouTube, Wretch…). Since customers refer to Google as a serious (academic) search engine, so we’ll focus on the “news worthiness” of our text messages.

Proposed AdWords Strategy

The ad copies will be written in Chinese, but will be connected with few English keywords to increase impressions. Because Snow Factory doesn’t own a store display, hence Geo-targeting ads coupled with Google Maps will not work.

Considering the current trend of the business, the target audience is still all females, and those health conscious males who don’t mind a little sourness in yogurt. The coverage area is all Taiwan.

So far we have come up with 3 ad groups. The corresponding themes are: Winter/Christmas, Beauty/Health, New business/Entrepreneurship. The three text ads with their corresponding keywords are as follows:

1. 雪坊優格 冬季最美的甜點

100%林鳳營鮮乳製造雪白優格,搭配繽

紛的天然果醬,最時尚的聖誕禮物。

(Keywords: 布丁, 甜食, 下午茶, 聖誕節, 冬天, 冬季, 雪, 爬山, 鮮奶, 鮮乳, 甜點, 果醬, 天然, 時尚, 禮物, 優格, 優酪乳, 奶酪, 乳製品, 林鳳營, 果粒, 果肉,Christmas, x-mas, winter, )

2. 雪坊優格 時尚美容聖品

純手工優格,100%天然食材,僅市售1/2

的卡路里,享瘦同時,美麗加分。

(Keywords: 手工, 天然, 食材, 卡路里, 熱量, 瘦身, 瑜珈, 美容, 美白, 曬黑, 肌膚, 減肥, 發酵, 代餐, 消化, 零食, 美女, 鮮奶, 鮮乳, 莎拉奶奶, 植物的優, 林志玲, 楊丞琳, 優沛蕾, 大滿足, 才不會忘記你呢, Christmas, x-mas, winter, )

3. 雪坊優格 研究生創業夢想

三位台大商研所學生,製作香滑細緻的優

格,一同來感受細心與耐心的創業故事。

(Keywords: 商研所, 台大, 台灣大學, EMBA, 大學生了沒, 大學生, 研究生, 蘇立文, 黎懿慧, 周慶麟, 創業, 創新, 微型企業, 創意, 中小企業, 白手起家, 政大法律系, 故事, 感人, Made in Taiwan, Taiwan)

Negative Matches: 鬼, 吃到飽, 樹, 公公, 聖誕帽, 舞會, A片, 肥皂, 資源, 石材,

Although Wretch, the second most visited site in Taiwan, is not listed among Google content network list, but based on our budget performance, we’ll use content network from time to time.

Our three week 2000NTD budget will be distributed as 650NTD, 350NTD, and 1000NTD respectively. After checking each keyword on keywords ideas by Google, we have found out that the keywords we have selected cost around 2NTD per click (dieting, and loosing-weight are around 15NTD). Daily budget will be allocated as 2/3 of the weekly budget over Monday to Friday, and remaining 1/3 over Saturday and Sunday.

Our goal is to increase Snow Factory’s sales and brand awareness by burning all of the 2000NTD over the whole project period. Considering average CPC as 2,5NTD, our projected clicks are 800 clicks. Projected impression is around one million eyeballs.

Keyword advertising is a trial-and-error business. Therefore, we’ll adjust our bidding, and budget maximum daily to filter out the most suitable keywords for the most suitable time.

Because, Snow Factory’s online contents do not offer direct sales online (online credit card payment e.g. PayPal), it is difficult to measure more conversion rate accurately. We’ll take each download (click on .xl file) of the order form of Snow Factory as real buyer, and each clicker on our ad as potential customer.

Monday 17 November 2008

News from the gov.

2. People lived in Taipei are doubted consuming tainted diary product for a long time so that they could approach six assigned hospitals to do the examination for free.

3. People could apply for free examination of dairy product.

Customers feedback

1. Compare to Osiana

a) Yogurt’s Taste: Some customers think snow factory’s yogurt is less sour than Osiana’s but the jam is sweeter.

b) Packaging: Snow factory sells a dozen at a time, comparing to Osiana’s 2 bottles in a box so that customers can choose more flavor.

2. When customers write them an email could get a quick response. And customers also impressed with their attitudes toward introducing their yogurt.

3. The size of a cup of yogurt is much bigger than a customer imagined.

4. A customer suggests a person to buy a dozen of yogurt with friends because of 12 expiration date is a bit short.

5. A customer thinks their yogurt up to certain “expert” level from the packaging to the quality.

6. Customers like mulberry and strawberry flavors the most.

7. I don’t see any negative feedback so farJ

Snow factory's Competitors

Snow factory and Osiana provide similar products. The main difference is yogurt’s packaging and the slight different of taste.

2. Asenka (spooning yogurt植物的優): http://www.asenka.com.tw/HerbU/product_1_a.asp?SID=33

The company invites a super model in Taiwan to promote their yogurt and have several TV commercial. This yogurt now is the most famous brand in the market.

3. Yoplait (spooning yogurt): http://www.yoplait.com.tw/yoplait_b.htm

Yoplait invites a popular singer for advertising. Their product positioning is a quite similar with Asenka.

4. Uni-President (Rui-Sui Drinking Yogurt): http://www.uni-president.com/05products/products01.asp

5. Asenka(Drinking Yogurt) http://www.asenka.com.tw/bifido/product01.asp

Sunday 16 November 2008

Saturday 15 November 2008

Video Reports

39 NT for a cup, in Taichung.

Keywords: slippery(?), good for digestion, Curry Yogurt, 原味(original taste, or natural taste) yogurt, QQ, 軟軟, 夠純, 天然果醬, 好吃,又沒有負擔, 吃起來不像一般手工作的那麼的酸, 裡面的回憶君,活益菌多, 嘗起來很細緻, 外面的優格比較粗(?), 優格沙拉, 新鮮的優格飲料是老外的最愛, Not Sweet (in taiwan, everything is very sweet, in Canada we don't like sweet), a little bit sour, or natural, thick

http://www.youtube.com/watch?v=xtuLykH8Wd0&NR=1

Snow Factory:

http://www.youtube.com/watch?v=6qNgUwFsdQs&feature=related

Pre-campaign rough draft (I also emailed it, formatting didn't hold)

Client Profile

http://liyihui.myweb.hinet.net/newstore2.html

Snow Factory is a homemade yogurt producer located in Taipei, Taiwan. It was founded in July 2007 by founders of the company. There are currently 3 employees. Snow factory offers on and offline purchases. Sales are made through online, phone, fax, email, yahoo bidding, skype and in store.

Market Analysis:

Snow Factories yogurt is made by 100% pure high quality milk from Taiwan. Sugar-free yogurt and jams with numerous choices of jam fruit flavors are offered. The company ensures quality in their products by not using milk powder and artificial additives. Snow factories current competitors include all yogurt producers; drinkable to scoopable types. They have one direct competitor that is in the same type of business and is located in Taipei, Taiwan. There current consumers are students and potential consumers are in the populations of; health conscious, diet, vegetarians, mothers and environmentalists. Snow Factories yogurt focus offerings position in the industry of dairy products is at the early majority position (34% users) of the S-curve. The company uses their blog as a social-networking marketing tool. Snow factory is unique in that they offer a wide variety of sugar-free fruit flavored toppings as well as being an exclusive online company.

Current Marketing:

Snow Factory offers a website for view of product offerings. Unfortunately the website is not structured in a user friendly way; all information on one page. We feel we can give the company some suggestions in how to improve the website. The website does not contain information on the background or development of the company. On the other hand it does have specifics about the yogurt, jams, purchasing, pricing, quality assurance and instructions. Advertising?

The website provides different detailed information for their customers. Instructions about keeping yogurt fresh: refrigeration time and time to eat it before it is spoiled.

Ammra please help us by adding more content to this area ( supposed to be a couple paragraphs)

Conclusion on how the Adwords campaign should align with the clients business

The campaign will focus on the value Snow Factories offers through its products and services. By identifying what provides value we can then know how to initiate the campaign. Our chosen campaigns all align with the unique attributes of the yogurt as well as what we think customers would be looking for. We feel this company has lots of room for improvement and we see adwords as a tool to jumpstart this improvement.

Proposed Adwords Strategy

Our Adgroups currently include; flavors, descriptive, benefits, occasion and ingredients.

Flavors Descriptive Benefits Occasion Ingredients

Dahu Strawberry Smooth Healthy Summer jam

Mango Creamy Diet milk

Blackberry Handmade Digestible No- milk powder

Lichee & honey Fruity Refreshing dairy

Papaya Fresh Beauty

Apple No-sugar Healthcare

Passion Fruit Dessert Body care

Sugar-free Yogurt (natural)

Low-calorie

Daily and Weekly plan for spending campaign budget

Our target audience settings are health conscious, diet, vegetarians, mothers and environmentalists.

Ad serving options

Keyword Bidding

Geotargeting

Goals

Metrics

Campaign structure and goal

Campaigns Markets Goals Ad groups

1 Customers who are health conscious Categorized by benefits and descriptive

2. Customers who are searching new tastes Increase our customer base Categorized by flavors and description of the products

3. Customers who have babies or young children Increase awareness of yogurt health benefits for the young Categorized by benefits

4. Costumers with environmental concerns Build an brand environmental image Categorized by Benefits

Things to keep in mind when running AdWords

Successful online marketing requires 3R's.

-Reach

-Relevance

-ROI

In Google AdWords, Page rank identifies where the ad will be placed.

Adwords components:

-Headline (25 Characters)

-Description, or the body of the ad (2 lines of texts, 25 characters each)

-Display URL

The first two are called Ad Copy.

Google Search and Content Network

One should answer 8 questions before launching a campaign:

1. Where are your customers located?

2. What language will your ad be written in?

3. What website will your ad link to?

4. What will your ad say? (Can start with free ideas by Google)

5. Which keywords do you want to trigger your ads? (Keywords must be directly related to the ad)

6. What is your payment currency? (usually USD)

7. Waht is your monthly budget?

8. How do you want Google to contact you in the future? (perhaps requires GMail account)

Standard edition Account Structure:

Ad1.1.1 (Keywords1.1.1.1)

-AdGroup1.1: Ad1.1.2 (Keywords1.1.2.1)

-Campaign1:

AdWords Account: -AdGroup1.2: Ad1.2.1 (keywords1.2.1.1)

(Keywords1.2.1.2)

-Campaign2: -AdGroup2.1: Ad2.1.1

Ad2.1.2 (keywords2.1)

Ad2.1.3

Campaign: -Keword Targeted (Search engine) CPC

-Site Targeted (Content Network) CPM

Keywords structure: -Campaign name

-End Date

-Daily budget

-Distribution preference: -Google homepage

-Search network

-Content network

-Langage targeting (if we are choosing TW chinese, then the ad will be shown only on google.com.tw, or on google.com if the user's browser preference has been set to receiving TW chinese contents)

Ad campaigns are valued by a factor called Ad Text Relevance: The ad-text should contain the keywords assigned to it; the relevant the ad groups are, the lower the Min.CPC.

Minimum CPC VS. Maximum CPC:

Each keyword in an AdGroup is automatically assigned with Min. CPC rate. Bidder should set its Max. CPC above the default Min.CPC to have his or her AdGroup placed on Google page. The more relevant, or the higher the Rank of the Ad, the lower the Min.CPC, hence the lower the Price of the ad.

Ad Rank: Max.CPC x Quality Score.

Quality score here is measured by the relevance of the ad.

One can raise the Ad Rank of by doing Omptimization

Optimization can be achieved by: -Adding new keywords

-Adjusting maximum CPC

-Reorganizing AdGroup

-Rewriting Ads

-Changing targeting options

-Adjusting keyword marketing types

-Choosing relevant URLs (Google checks the contents in those URLs, and compares its content to the keywords chosen for the ad, if they match, the higher the AdRank)

So, in a nutshell, the higher the quality score, the lower the Min.CPC, the lower the price of running the ads.

If one can't see their ads on Google, use: 1.Ads Diagnostic Tool, 2.Disapproved Ads Tool.

Ad Formats: -Text Ads

-Local Biz Ads (using Google Map, appear on car GPS)

-Mobile Ads (on cell phones)

-Image ad

-Video ad

To better utilize each keyword, use Keyword Tools by Google.

Creating Keywords:

1. Match: -Broad Match: Ex: "Purebred Puppy" - any phrase containing any of the keywords.

-Phrase Match: Ex: No words between "Purebred" and "Puppy"

-Exact Match

-Negative Match: Eliminates phrases like cheap, free... Ex: "-free", doing so eliminates all searches with "Purebred Puppy" and "free" in it.

2. Scrub: 2-3 words phrases work best

3. Group: group the keywords according to similar themes, products, types...

4. Test and Refine: Learn as you walk. Build your campaign on those keywords that work and eliminate poor performing ones.

Writing Successful Ads:

1. Highlight differentiating characteristics

2. Include keywords in the ad title (Will appear in bold)

3. Include prices and promotions

4. Include call to action: Action verbs: buy, order, purchase...(while find and search are more accurate verbs, but it would show that the customer is still in his awareness/interest mode +[customers go through cognitive-affective-behavioral stages before purchasing a product or service])

5. Avoid using company names, websites in the ad text (unless it is an established company with compelling brands)

6. Capitalize the words in display URL: Ex: "WarmPuppies.com" not "warmpuppies.com"

7. Choose URLs that points visitors to landing pages. (Products should be visible on the landing page)

Choosing Relevant Landing Pages:

Ad words measure landing page quality. The page should contain texts, photos that tell the company's products, expecially those that are relevant with the keywords chosen = Hihger Quality Scores

Landing page should: -Allow users find what the ad promises

-Openly share info about the business

-Clearly define what the biz is, or what it offers

The best flow is: Landing Page - Transaction - Checkout

Well-run campaigns have: -Active Keyword Status

-Low Min. CPC bid

-High CTRs

Optimization tricks:

1. 2-3 word keyword phrases

2. Use keyword matching options

3. Make sure keywords relate to the product

4. Use keyword variations (synonyms, alternate spellings)

5. Similar keyword groupings, themes, ads that focus on that group

6. Write clear, compelling ad text and title

7. Include call to action in the ad text

8. Send users to the best possible landing page

9. Test multiple ads per ad group

Tracking performance

Measuring conversions through: -Purchase

-Sales lead (submit contact info)

-Download

-Subscription

-Page view

Return on Ad Spend ROAS = (ROI) = (Sales Revenue - Ad Cost) / Ad Cost

Friday 14 November 2008

from Deniz : after friday meeting notes

MKT analysis

Industry analysis

l Dairy products

l Desserts

l Food services

l Confectioners

l Dairy products

Current potential costumers: blogs

ADwords:

l Flavors (mango, black berry, lizhe&honey, papaya, apple, passion fruit,

)

l Natural

l Smooth

l Creamy

l Handmade

l Healthy

l Fruity

l Dairy

l Jam(homemade)

l Homemade

l Fresh

l Dahu strawberry

l Specialty yoghurt

l Diet

l Digestible

l No sugar

l Summer

l Refreshing

l Dessert

l Beauty

l Health care

l Body care

l Sugar free

l Milk(high quality)

l Yoghurt (natural)

l No milk-powder yoghurt

l Low calorie

l Low calorie yoghurt

l Environmental

3 ways of ordering : telephone, e-mail(the way to calculate CTR and download the form), yahoo

Number of employees and capacity

˙Current and potential customers

Current: students

Potential customers: health conscious people, dietary, vegetarians

˙competitors: yogurt producers of any size (at lower price)

Spoonable yogurt producers, drinkable yogurts

Osiana:

http://www.wretch.cc/blog/osiana/5369107

˙overview of the industry: emerging industry in Taiwan with ?? competitors

˙government control: after the melamine-poisoned milk powder incident, the regulation has become very strict.

˙projected online spend of the industry, competitors how they advertise online

˙market positioning

Attributes: digestion, health, low calories, home-made, natural, fresh

Price:

To : Amraa

Ok we will meet in mba lounge at 4:30... see u there hope shelly reads this before so late ..

Thursday 13 November 2008

Called the manager

Also, are we meeting tomorrow at 4:30 PM? Where? How about 活大 (the student activity center by the main library - the one with red doors), or B1 of library?

I have a class from 3:30 to 5:20. Please respond to this post quickly, so that we can discuss earlier.

From Deniz: Some Parts form the book: "Marketing and Advertising Using Google"

Selecting keywords is one of the most important parts of creating a successful AdWords campaign. To pick the best keywords, use this five-step process:

1) expand

2) match

3) scrub

4) group

5) refine

Step 1: Expand

First, come up with as many relevant keywords as possible. What does the business sell? What are the advertiser’s goals? If it’s to sell purebred puppies, some good keywords might be ‘purebred puppies’ and ‘purebred dogs.’ Even better are keywords focused on specific breeds, like “poodle.” List all keywords that come to mind. It’s a good idea to avoid less specific keywords, like ‘dogs,’ which usually cost more and usually don’t relate to a user’s specific search.

AdWords also provides a Keyword Tool (www.google.com/adwords/keywordtool) that generates keyword ideas (shown in Image 3-1). Access the Keyword Tool, enter keywords similar to the ones you want to find, and sort the results.

Step 2: Match

Google offers different keyword-match types to relate to a user’s search. They include broad match, phrase match, exact match, and negative match.

• Broad match means that all searches using that word (in any order or combination) will display the ad. For example, ‘purebred puppy’ will show an ad for all searches with the words ‘purebred’ and ‘puppy’. This could include searches for ‘buy purebred puppy’ and ‘puppy that is purebred.’ This is the default setting for all keywords.

• Phrase match requires the words to appear in order. “Purebred puppy” (entered with quotation marks) shows ads for searches with ‘purebred’ and ‘puppy’ in that order, as in ‘purebred puppy Chihuahua.’ Ads won’t appear, however, for searches with any words between ‘purebred’ and ‘puppy’. This narrows the audience.

• Exact match shows ads when the exact phrase is used in the search – without any other words before, between, or after. So ‘[purebred puppy]’ (with brackets) shows an ad for searches with just the words ‘purebred puppy’, not ‘purebred puppy advice’ or ‘purebred puppy veterinarian.’ This further narrows the audience.

• Negative match eliminates phrases for which an advertiser doesn’t want an ad to appear, such as ‘cheap’ or ‘free’. Negative matches are selected by entering negative keywords with a minus sign, such as ‘-free.’ This option prevents an ad from showing to people searching for ‘free purebred puppy.’

Step 3: Scrub

AdWords is geared toward relevance. Keywords that maintain the same standard give strong results. Irrelevant keywords should be removed from the keyword list. Delete any words that don’t relate to the advertiser’s business. Two- to three-word phrases are usually best.

Step 4: Group

Keywords should be organized into similar themes, products, or types in separate ad groups. This way, each ad can be written specifically for similarly grouped keywords.

For example, here’s a good way to separate keywords for chocolates into three different ad groups:

Step 5: Test and Refine

Users are constantly searching for different things, so advertisers must regularly test and refine keywords. Build on keywords that work, and delete others that don’t.

Boxed Chocolate

Valentine’s Chocolates

Swiss Chocolate

Keywords:

• boxed chocolate

• chocolate gifts

• assorted boxed chocolates

• gourmet chocolates

Keywords:

• valentine chocolates

• valentines chocolates

• buy valentines chocolates

• valentines candy

• valentines chocolate box

Keywords:

• swiss milk chocolate

• swiss dark chocolate

• swiss chocolate

Monitoring Performance and Analyzing an Ad’s Quality Score An advertiser enters a keyword and ad into the system. Now what? With traditional advertising, the work is done. However, with online advertising, monitoring performance and maintenance are part of the advertising model. Most importantly, advertisers should pay attention to Quality Score. Recall that Quality Score measures an ad’s relevance and sets the minimum CPC bid required for an ad to enter the auction. Ads with higher Quality Scores tend to: • get more clicks • be shown in higher positions on search results pages • bring more businesses and customers together Keyword Status Keyword status determines whether an ad is eligible to run in the auction. In other words, it determines whether a keyword is eligible to trigger ads on search pages. The keyword status appears in the ad group view (Image 3-2). There are two keyword statuses: • Active: The keyword is eligible to run in the auction (the maximum CPC bid is above the minimum CPC bid required) • Inactive for search: The keyword isn’t eligible to run on Google or on Google’s search network because the maximum CPC bid is below the minimum CPC required. (Note that the ad may still be shown on the content network.)

If keywords are inactive for search, the system offers a minimum bid required to activate that keyword. There are four ways to reactivate an inactive-for-search keyword: 1. Increase the keyword’s Quality Score through optimization. 2. Increase the keyword’s maximum CPC bid to the minimum bid suggested by the AdWords system. 3. Delete the keyword (if the minimum CPC bid to reactivate it is too expensive). 4. Do nothing. Occasionally, as AdWords gathers more data about a keyword (or as the factors incorporated in Quality Score change) a keyword may be re-activated without any action from the advertiser. However, doing nothing is not recommended.

Optimize Ads to Boost Performance andQuality Score

So far this lesson has covered strategies for developing effective keyword lists, writing quality ad text, and choosing relevant landing pages. Low Quality Scores usually stem from a problem in one of these areas.

Therefore, an advertiser can boost performance and Quality Score by picking and refining relevant keywords, writing powerful ad text, creating high-quality landing pages, and constantly testing and monitoring which techniques work best.

In summary, here are some optimization tricks to boost performance:

• Use two- to three-word keyword phrases

• Use keyword matching options

• Make sure keywords relate to the product

• Use keyword variations (such as synonyms or alternate spellings)

• Create similar keyword groupings, or themes, in each ad group, and ads that focus on that group

• Write clear, compelling ad text

• Include keywords in the ad text and title

• Include a call to action in the ad text

• Send users to the best possible landing page

• Test multiple ads per ad group

Going Local: About Local Business Ads

Local business ads are AdWords ads associated with a specific geographical location. They can appear when a user searches for specific businesses or services in the user’s geographic area. This option gives advertisers a good way to reach local customers. Local business ads are eligible to appear in two places:

• On Google Maps (maps.google.com) in the enhanced manner shown in Image 5-2.

• In the regular text-only format on Google.com and other sites in the Google search network.

Local Business Ads on Google Maps

Google Maps displays an interactive map next to both organic search results and paid AdWords ads. When a user enters a geographic search query, organic search results appear on the left-hand side of the map. Each of these listings is marked in the search results and on the map by a red balloon.

Local business ads appear above or below organic search results, are highlighted by a blue background, and are clearly labeled Sponsored Links. Up to four sponsored listings may appear per search. Each of these listings is marked on the map by a small white balloon. When the ad is clicked, the balloon expands into an information window over the physical location of the business on the map (Image 5-2). This larger balloon can contain:

• A headline (25-character maximum)

• Two lines of creative text (35-character maximum per line)

• A small, eye-catching image (125 x 125 pixels)

• A display URL

• The business name and address

Users who click the URL in the ad or in the information window are taken to the advertiser’s website.

Local Business Ads on Google.com and the Google Search Network

A text-only version of each local business ad is eligible to run on Google.com and other search sites in the Google search network. The way an ad looks varies by search partner. Typically, ads are labeled as Sponsored Links and include two to four lines of text.

In most cases, text versions of local business ads include the same ad text and display URL as the enhanced ads running on Google Maps. An additional fifth line of text also appears that includes the city and state of the business (if applicable).

Quick Performance Tracking: Campaign Summary Metrics and the Report Center

There are two ways to quickly glean AdWords performance data: through metrics on the Campaign Summary page and through the Report Center.

Campaign Summary Metrics

AdWords provides the following information on the Campaign Summary page:

Clicks

Clicks are the basic measure of success of an AdWords ad. Successful keywords are relevant and generate a lot of clicks at a low CPC. However, clicks can be deceiving. Clicks may just be a sign that people are curious about an ad; people may click on an ad frequently, but rarely turn into customers.

Click-through Rate (CTR)

Keywords with high CTRs may indicate that a keyword and ad are giving people what they want – and leading to conversions. But again, a high CTR is no guarantee of conversions or ROI.

Impressions

If generating awareness for a brand is important, the number of impressions can be a sign of success.

AdWords Reports AdWords reports (located in an advertiser’s ‘Reports’ tab) generate customized performance data for multiple facets of an AdWords account. Key features include: • Performance stats for site/keyword campaigns, URLs, ad groups, and the account • Customizable report columns to focus a report on only relevant data • Performance filters to screen for the most relevant information in categories such as cost, impressions, clicks, and CTR • Simple scheduling to automatically generate reports and deliver them to multiple recipients • The ability to create report templates for reuse

Meeting Snow Factory in Person

Dear 蘇立文、黎懿慧

As our pre-campaign strategy deadline is approaching, we would like to meet you in person, and ask several questions concerning your marketing positioning (including online marketing strategy), your industry background (competitors, consumers, seasonality of your goods...).

If possible we would like to meet you tomorrow, the Friday of November 14th. It will take less than an hour, and please don't worry about language barrier, we are able to converse both in Chinese and in English.

We'll bring the Google's official Letter to Business along with us. If not mistaken, your address is: 台北市中正區汀州路二段201巷7號1樓. Hope to hear from you either by mail or telephone soon.

Regards:

鄯安宇, 學號: B94701155

手機: 0953267493

工管系四年級

國立台灣大學

Because I have just sent it, so haven't received any answer yet. Hopefully they will let us see them tomorrow. I have class at 3:30, but if they agree to see us, I will just ditch it (we are too close to the deadline). The questions to be asked are according to what Google requires for pre-campaign strategy report contents. I will print out the official letter to business tomorrow. Hope that you all have been over the requirements, and I will need at least one person to come with me to the place, otherwise I will have hard time to be convincing. Please be sure to read what areas should be covered in the pre-campaign paper. Most of the answers will be provided by the business. Contact me through any method, as I have put my phone above...

Regards:

Amraa

Setting up an effective campaign

Step 1. Stick to one goal per campaign:

Ex: What do i wnat to achieve with the campaign?

Sell more coffee beanrs or gift baskets...

Separate campaigns by theme or product line.

Step 2. Make Ad Groups out of your keywords:

Organize Ad Groups by common theme or product.

Group similar keywords together.

At least 3 groups per campaign. Make distinct Ad Group for each group of keywords.

Step 3. Review, test, and refine

Are the keywords logically grouped into Ad Groups?

Does the budget match the goal? If the budget is low, trim the

number of keywords.

*Keyword matching options: broad, phrase, exact and negative match.

Selecting Keywords

Selecting keywords is one of the most important parts of a successful campaign. For information on how to choose the right keywords we encourage you to read Lesson 3 of the ‘Marketing and Advertising Using Google’ textbook from page 53 onwards. Understanding how to choose and structure your keywords will help you perform strongly in the competition.

In addition to keywords, picking the right landing page and creating compelling ad text are critical to optimizing your campaigns. Lesson 3 in the ‘Marketing and Advertising Using Google’ textbook will provide you with useful tips and tricks on this.

TIP: When you’re creating your keyword list remember negative keywords, which will help you create more targeted ads and reach the right audience! Negative keywords can be set at the Ad Group and campaign level. You can find more information on this and decide which level works best for you at http://adwords.google.com/support/bin/answer.py?answer=6635

Dos and Don’ts for account structure and campaign management

Do…

• create multiple Ad Groups per campaign

• group Campaigns by theme, geography or product line

• make it easy to maintain

• continue refining your keywords and ad text

Don’t…

• create just one Ad Group and a big list of keywords

• mismatch keywords in one Ad Group

• run dozens and dozens of keywords for a low budget

• stop checking your campaign statistics

What is the Quality Score?

The quality score is based on: the keyword’s click-through rate (CTR), relevance of your ad text, historical keyword performance, landing page quality, and other factors specific to your account. You can find more information on how the Quality Score is calculated at

http://adwords.google.com/support/bin/answer.py?answer=10215. Based on this Quality Score, we assign your keywords a minimum bid you must pay per click in order to keep your ad running for any one of your keywords.

TIP: It is possible to view the current quality score status for your keywords. To see your Quality Score in your account statistics follow the steps listed at

http://adwords.google.com/support/bin/answer.py?answer=53024.

TIP: Learn how to improve your ad’s performance and optimize your campaigns on page 62 of the ‘Marketing and Advertising Using Google’ textbook. You will find emergency tips and tricks to help you improve your quality score!

One can choose between Google's Search Network (patnered with AOL, shopping.com, ask.com) and Content Network(partners with about.com, lycos.com, nytimes.com).

The Challenge has two written components and one computed component.

• Pre-Campaign Strategy

• Post-Campaign Summary

• Campaign Statistics

It takes great Campaign Statistics to make the regional top five, and then great written reports to win.

Written Report Format

All written reports should be in English and use the following formatting: 12-point Times font, 2.54cm page margins, A4 paper, left-justification, 1.5 line spacing. A4 paper is a standard paper size, in the ‘Page Layout’ section of most word processing programs.

Pre-Campaign Strategy (30 points total, maximum four pages, submitted in English)

In addition to assessment of Communication and Readability (5 points), the Pre-Campaign Strategy has two components. A Client Overview (12 points) helps your team craft and defend your draft AdWords Strategy (13 points). Combined, both components should be a maximum of four pages. Ideally, the groups would gather input from their client SMEs in developing the Pre-Campaign Strategy. All groups must submit the Pre-Campaign Strategy to their professor and to Google.

Client Overview (12 points, about two pages)

This section provides a brief overview of the client and their marketing, as a foundation for the proposed AdWords Strategy.

• Client profile (2 points, a few sentences including some of the following. Please note that some clients may not want to share some information. You may note this in the report if this is the case)

- Name, location, url

- Sales and number of employees

- Goods and services offered

- Key online marketing personnel

- Age of the company

- url, website age, website management

- Company presence and sales via online and offline channels

- Other relevant information

• Market analysis (4 points, about a paragraph including some of the following)

- Current and potential customers

- Current and potential competitors

- Overview of the industry (key characteristics, competitive/saturated/mature)

- Projected and historical online spend for the industry

- Market position/specialties

- Unique selling points of the goods/services offered

- Seasonality of their goods/services or seasonality that the company has identified

- Other relevant market information

• Current marketing (4 points, a couple of paragraphs including some of the following)

- Website uses, e.g. sales, customer service

- Website strengths and weaknesses

- Website visibility, such as Google PageRank, incoming links, a few keyword search results, online advertising, and offline promotion of the url.

- If available, summary information from Google Analytics or other third party web tracking software

- Email campaigns

- Offline advertising

- Other online or offline marketing

• Conclusion on how the AdWords campaign should align with the client’s business (2 points, a few sentences)

Proposed AdWords Strategy (13 points, about two pages including sample AdWords and keywords)

Based on an analysis of the client, their website and their marketing, teams should craft an appropriate AdWords Strategy and metrics for their campaign. The Proposed AdWords Strategy should include:

• Number of Ad Groups and the focus for each Ad Group.

• Keywords and negative keywords

• Text for at least two AdWords versions for each Ad Group

• Daily and weekly plans for spending their campaign budget

• Network(s) for their AdWords ads

• Target audience settings

• Ad Serving options

• Keyword Bidding

• Geotargeting

• Goals for impressions, clicks, CPC and CTR

• Proposed success metrics

• Other relevant information

Communication and readability (5 points)

The Pre-Campaign Strategy should have a logical flow, be easy to follow, use proper English and avoid grammatical mistakes.

Post-Campaign Summary (70 points total, maximum eight pages submitted in English)

The Post-Campaign Summary has three components, an Executive Summary (6 points),

Industry Component (24 points) and Learning Component (20 points). The assessment also includes Communication and Readability (10 points), and relevant use of Tables, Figures and Charts (10 points).

Executive Summary (6 points, one page)

This stand alone document provides your client with a project snapshot and highlights four key factors:

1. Campaign Overview – a basic review of the project by introducing the campaign goals and operational details.

2. Key results – discuss the overall campaign performance as well as the performance of each ad group. Specifically, you will want to reference each group as well as the overall campaign. This section should provide a brief overview of the key metrics.

3. Conclusion – a clear synthesis of the content of the report and key items. This is your chance to tie together the entire package and focus the client’s attention on the most important project aspects.

4. Future Online Marketing Recommendations – simple, actionable and well-justified advice on what your client should do in the future with respect to online marketing.

Develop the Executive Summary after you generate all other content, as it summarizes and will overlap with your content in the Industry Component.

Industry Component (24 points, maximum four pages)

This is the team’s chance to share the results with their client and expand upon the Executive Summary. The ideal approach is to write the Industry Component first and then summarize this content for the Executive Summary. As a rule, you would include most if not all of your Charts, Tables and Figures in your Industry Component and cover the following areas:

1. Introduction – Overview the Industry Component section and introduce it’s core content.

2. Campaign overview:

• Review the major campaign goals (strategic goals as well as metrics: CTR, CPC, and Impressions, etc.) set prior to the project and discuss your general strategies for approaching each goal

• Operational details (campaign dates, money spent, ad groups used). Review the basic schedule and cost structure you followed, your methods for monitoring the account, etc

3. Evolution of Your Campaign Strategy:

• What were the major changes you made during the campaign and what led to these changes?

• How did these changes affect your campaign?

4. Key Results – Summarize your results based on three weeks of data, such as:

• Overall performance of the campaign and individual ad groups

• Discussions of performance of the initial campaign and changes in performance following your optimization efforts

• Discuss the keyword combinations that were effective and ineffective

• Highlight your success stories and make quick, but clear references to the failures you experienced

• When discussing performance, refer to the metrics such as:

- Impressions

- Clicks

- Click Through Rate

- Average Cost per Keyword

- Total Cost of Campaign

- Other metrics provided by the client, such as conversions

5. Conclusions – Synthesize the Industry Component, tie together the entire package and focus the client’s attention on the key project aspects. Take this opportunity to repackage all the information from the data section to display your practical lessons learned to the client. The goal here is to develop a great transition that summarizes the critical results and starts to link these results to the future recommendations in the next section.

6. Future Recommendations – Provide simple actionable and well-justified advice on what your client should do in the future with respect to online marketing.

Learning Component (20 points, maximum three pages)

The teams’ reflection on what they learned should cover four points:

1. Learning objectives and outcomes – what did the team hope to learn? How well did the

team meet their learning expectations? What else did they learn? What key outcomes will the team remember? What were the expected and unexpected outcomes from participating in the Challenge?

2. Group dynamics – what problems did the team encounter and more importantly, how did they overcome these problems? What were some of the expected and unexpected outcomes from working as a group?

3. Client dynamics – what problems did they encounter and as importantly, how did they overcome these problems? What were some of the expected and unexpected outcomes from working with the client?

4. Future recommendations – what would they do differently in the future to improve their campaign strategy, learning experience, group dynamics and client dynamics?

Communication and readability (10 points)

The Post-Campaign Summary should have a logical flow, be easy to follow, use proper English and avoid grammatical mistakes.

Charts, Tables and Figures (10 points)

Teams should intersperse relevant charts, tables, figures to illustrate their results. In addition, teams should label and refer to the charts, tables and figures in the body of the report.

To succeed in the Campaign Statistics you should ensure your team is doing well across the areas listed below.

A) Account Structure

B) Optimization Techniques

C) Account Activity & Reporting

D) Performance & Budget

E) Relevance

Important notes

Invalid clicks: The Challenge discourages Invalid clicks and Google has practices and procedures in place to detect invalid clicks in the competition. Students, classes and institutions risk disqualification for excessive invalid clicks on an account. You can read about how we detect and track invalid clicks at

http://adwords.google.com/support/bin/answer.py?answer=6114.

Competitors’ keywords: In many cases the use of a competitor’s name is subject to editorial and content restrictions, particularly if trademarked. Teams should review Google’s AdWords policies at http://adwords.google.com/support/bin/answer.py?answer=70534 to ensure their ads and keywords comply with these guidelines. Failure to comply with the guidelines penalizes a team’s Campaign Statistics.